With Pueblo Tires Credit Card Your Peace Of Mind Is Sure

Are you tired of dealing with complicated auto financing options? Look no further than the Pueblo Tires credit card. There credit card offers a simple and easy finance options for all your auto needs.

Using this credit card, you can easily manage your budget and make affordable payments. Plus, you’ll have access to quality products and services, ensuring that your vehicle is in top condition.

Key Takeaways

- Pueblo Tires offers a credit card for easy and simple auto financing

- The credit card provides affordable payment terms to manage your budget

- Access quality products and services with the Pueblo Tires credit card

- The credit card application process is simple and easy

- Apply for a Pueblo Tires credit card today and enjoy hassle-free auto financing

Easy Financing for Your Auto Needs

Looking for hassle-free financing options for your auto needs? Look no further than the Pueblo Tires credit card that offers easy financing with affordable payment terms that can help you manage your budget more effectively. With this credit card, you can get quick access to the funding you need to get your vehicle back on the road.

Whether you need to cover unexpected repairs or upgrade your car with new tires and wheels, the Pueblo Tires credit card has you covered. With simple monthly payments and no hidden fees, you can breathe easy knowing that you have a reliable financial partner on your side.

The Benefits of Using the Pueblo Tires Credit Card

- Easy application process

- No annual fee

- Low monthly payments

- Convenient online account management

- Special financing offers for qualifying purchases

Don’t let financial worries keep you from taking care of your car. Apply for a Pueblo Tires credit card today and experience the benefits of easy financing for your auto needs.

Quality Service and Products

At Pueblo Tires, they place a high emphasis on providing customers with quality service and products. And they understand that your vehicle is important to you and deserves the best possible care. That’s why they only make use of premium parts and equipment in there services, ensuring that your vehicle is always running smoothly.

With the Pueblo Tires credit card, you can access these quality offerings with ease. These credit card is designed to give customers peace of mind, knowing that they are getting reliable and durable products and services. You can trust them to take care of your auto needs and provide you with the quality service that you deserve.

From regular maintenance to major repairs, there team of experts will ensure that your vehicle is running at its best. Don’t settle for anything less than quality when it comes to your auto needs. Choose Pueblo Tires and experience the difference that quality service and products can make in your driving experience.

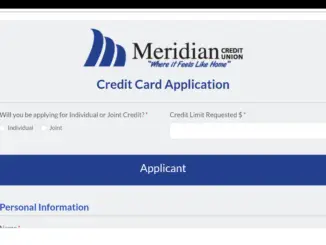

How To Apply for a Pueblo Tires Credit Card

Getting your hands on a Pueblo Tires credit card is easy as pie. Simply follow these simple steps:

- Head to the nearest Pueblo Tires store to fill out an application in person. Don’t forget to bring along your personal identification documents, such as a driver’s license or passport, and proof of income.

- If you prefer a more convenient option, you can also apply online at the Pueblo Tires website. The online application process is straightforward and user-friendly, taking only a few minutes to complete.

- Once your application is submitted, Pueblo Tires will review your information to determine if you qualify for a credit card. If approved, you will receive your card in the mail within just a few business days.

Applying for a Pueblo Tires credit card is hassle-free and requires minimal effort on your part. What are you waiting for? Apply now and start enjoying the benefits of easy financing for all your auto needs!

Conclusion

Now that you understand the benefits of the Pueblo Tires credit card, it’s time to take action. Applying for the credit card is easy and straightforward, so you can start enjoying the advantages of easy financing for your auto needs.

With affordable payment terms, quality service, and products, the Pueblo Tires credit card is the perfect solution for managing your budget effectively while ensuring your vehicle is in top condition.

Don’t wait any longer to take advantage of these benefits. Apply for a Pueblo Tires credit card today and experience hassle-free financing for your auto needs.

FAQ

Can I use the Pueblo Tires credit card for any auto-related expenses?

Yes, the Pueblo Tires credit card can be used for various auto-related expenses, including tire purchases, maintenance services, and repairs.

What are the benefits of using the Pueblo Tires credit card for financing?

By using the Pueblo Tires credit card, you can enjoy easy financing options that help you manage your budget effectively and make affordable payments for your auto needs.

What guarantees the quality of products and services when using the Pueblo Tires credit card?

The Pueblo Tires credit card allows you to access high-quality products and services, ensuring that you receive reliable and durable auto parts, tires, and maintenance services.

How can I apply for a Pueblo Tires credit card?

Applying for a Pueblo Tires credit card is simple. You can visit our website or one of our authorized stores to complete the application process. Just follow the steps provided, and you’ll be on your way to easy financing for your auto needs.

Do I need to meet any eligibility requirements or provide specific documents to apply for the Pueblo Tires credit card?

While specific eligibility requirements may vary, you will typically need to provide basic information such as proof of identity, income verification, and contact details. Our application process is designed to be hassle-free and straightforward.

Be the first to comment