The Meridian Credit Card Application

A Meridian credit card is a type of credit card offered by Meridian Credit Union, a Canadian financial institution. The card come in different types, with various features and benefits, To use a Meridian credit card, you must first apply for the card and meet the eligibility criteria set by the credit union. Once approved, you can use your Meridian credit card to make purchases and payments, and you will be required to pay back any balance owed plus interest charges.

If you’re looking for a new credit card or may have heard of the meridian credit card. This card has a number of great deal that can save money and help you manage your finances. In this article, we’ll take a look at some of the key features of the meridian credit card and explain why it could be a good choice for you.

Meridian credit card options

When it comes to credit card options from Meridian, there are several options available to consumers. Depending on your financial situation and the rewards and benefits that you prioritize, there are different cards that may better suit your needs. You can look out from the below listed cards

Meridian Visa Cash Back Card: This card offers cash back on eligible purchases and has no annual fee.

Meridian Visa Platinum Cash Back Card: This card offers a higher cash back rate on eligible purchases, along with additional benefits like travel insurance and extended warranty coverage. It does have an annual fee.

Meridian Visa Infinite Cash Back Card: This card offers a premium cash back rate on eligible purchases, as well as travel and lifestyle benefits like airport lounge access and concierge service. It also has an annual fee.

Meridian Flex Rewards Visa Card: This card allows you to earn points on eligible purchases, which can be redeemed for travel, merchandise, or cash back. It has no annual fee.

Meridian Visa Infinite Travel Rewards Card: This card allows you to earn points on eligible purchases, which can be redeemed for travel, merchandise, or cash back. It also offers premium travel benefits like airport lounge access and concierge service, but it has an annual fee.

RELATED:- Aamco Credit Card & Car Care

How does a meridian credit card work?

The Meridian credit card works like any other credit card. When you use the credit card to make a purchase, you’re essentially borrowing money from the card issuer, Meridian Credit Union. You’re required to pay back the borrowed amount along with any interest or fees charged by the issuer. The card comes with a predetermined credit limit that you cannot exceed without facing additional fees.

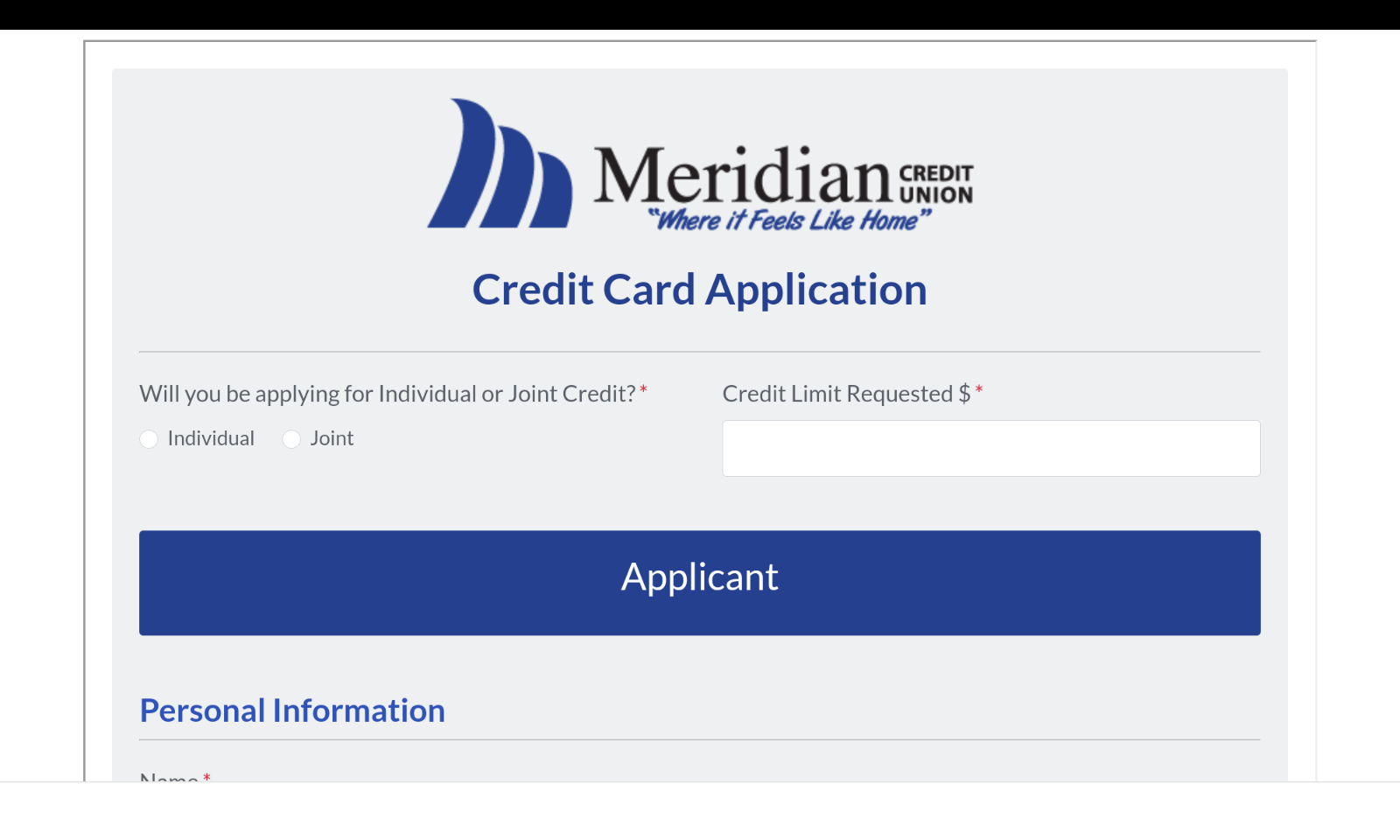

How To Apply For Meridian Credit Card Online

You can apply for a Meridian credit card online or in person. Here are the steps to apply online.

1 Visit:- mymeridiancu.org/credit-card-application

2. Fill out the application: Complete the application form, providing your personal employment, as well as your reference details and other information You will also need to provide your Social Insurance Number (SIN) to verify your credit history.

3. Review and submit: Once you’ve completed the application, review it for accuracy and then submit it.

4. Wait for a decision: Meridian will review your application and notify you of its decision. If approved, you will receive your credit card in the mail within a few business days.

How To Use A Meridian Credit Card?

Using a Meridian credit card is similar to using any other credit card. Here are the basic step to use the card, simply swipe it at the time of purchase or enter the card information on the online shop. When you get your monthly statement, you’ll see how much cash back you’ve earned for that month. You can then use that cash back to pay down your balance, or you can keep it in your account to use for future purchases.

Benefits Of A Meridian Credit Card

Meridian credit cards offer a variety of benefits that can vary depending on the specific card you have. Some common benefits of Meridian credit cards include:

No annual fee

2% of outstanding balance plus any overlimit amounts due monthly

25-day grace period on purchases

Lost/Stolen Card: 1 (800) 234-5354

Conclusion

As with any credit card, it’s important to carefully review the terms and conditions, fees, and rewards before applying to make sure it’s a good fit for your needs and spending habits.