The Best On Melaleuca Credit Card & Review

When you’re looking for a credit card, you want one that will suit your needs and help save money. A great resource for this is to review the best cards and Melaleuca credit card is one of them that offers good benefits on the market.

The Melaleuca credit card is an important product for its members. They offer special discounts to their members, such as points towards retail items and other benefits.

Those who are considering a Melaleuca credit card might be interested in some reviews of its pros and cons from customers who currently have it as well as unbiased third-party reviews. This would help them decide if they should sign up or not.

Melaleuca credit card is a rewards credit card that provides cardholders with special benefits and rewards. The cardholder is automatically enrolled in the company’s wellness program which provides them with discounts on wellness products and services.

The Melaleuca credit card has a no annual fee or foreign transaction fees. The minimum payment the customer can make is $25.

People who have credit scores below 620 may be required to pay up to $75 for their security deposit, which will be applied as a down payment for their balance at the end of their first billing cycle.

If you are interested in applying for the Melaleuca credit card, you can visit their online website or local stores perhaps call free number at 855-425-3187

Table of Contents

RELATED:- Melaleuca Credit Card [Best Tips]

Melaleuca Credit Card Review

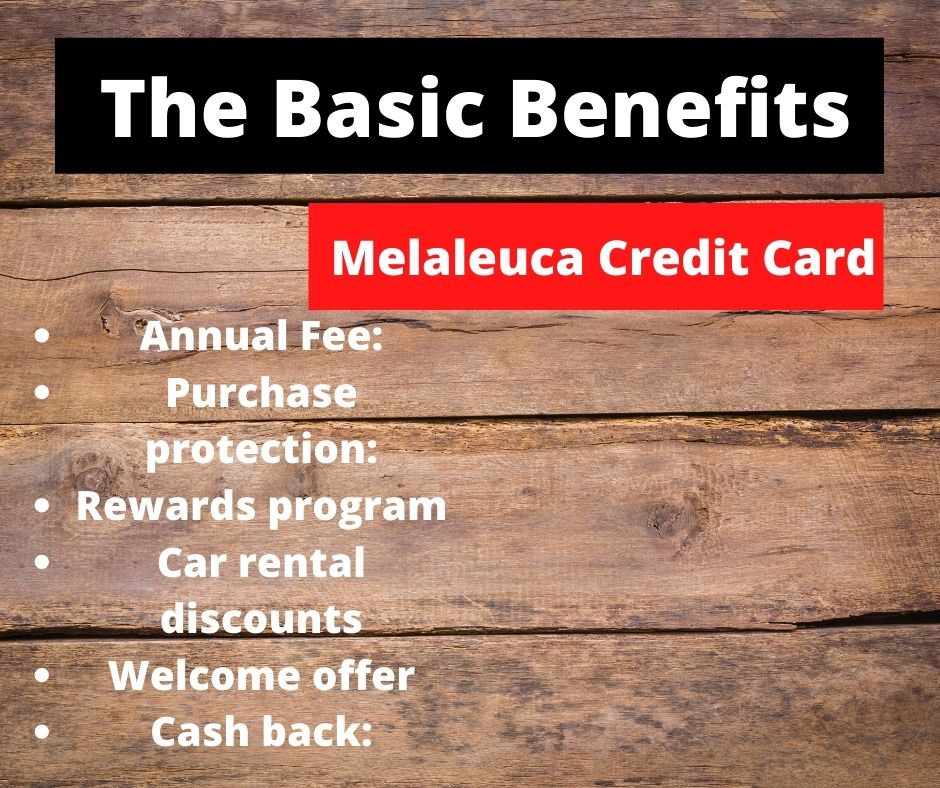

The Basic Benefits

The MBNA Melaleuca Mastercard is a great way to earn bonusnd rewards on everyday purchases includng other benefits listed below..

- Annual Fee:– No for Melaleuca Premium Cardholders.

- Purchase protection:- The Purchase Protection plan provides coverage for most items you purchase with your card. Coverage begins the day after your purchase and lasts for 90 days.

- Rewards program.:-The program is a great way to earn rewards on the products you love!, you’ll earn 1 point for every $1 you spend on the Melaleuca Credit Card. Plus, you’ll receive a $10 credit for every 1,000 points you earn. That’s like getting 10% back on all your purchases!

- Car rental discounts:- Melaleuca offers its members a variety of discounts and benefits, including car rental discounts from Avis, Budget, and Hertz. Members can also save up to 10% on hotel stays, and receive special rates on cruises and other travel-related expenses.

- Welcome offer:- As a new Melaleuca credit cardholder, you are eligible to receive a $100 bonus statement credit after making your first purchase with your new card.

- Cash back:- With this card, you’ll earn 2% cash back on all of your Melaleuca purchases, and 1% cash back on all other purchases. Plus, you’ll receive a $50 statement credit after your first purchase.

The perks

- Travel perks:- There are a lot of traveling benefits add up which includes no foreign transaction fees on other cards. Free checked bag for you and a companion, lost of luggage assistance and emergency card replacement services.

- Reliable customer service.:– The Melaleuca credit Mastercard customer service is always reliable, day and night you can contact them

- Zero liability insurance:- With the Zero liability insurance. you can always avoid paying for unauthorized use of your card

- Security features:- The Card offers more security than ever, Chip technology has been enhanced with added security features, such as online verification codes to authorize payments, fraud monitoring system and Zero Liability etc.

- Easy to qualify:- With this card, there is certainly no annual income required to qualify.

- Contactless payments:-Breeze through checkout with easy tap and go payments

What to Expect

The Visa card offers a number of unique benefits, which members are expected to take advantage and be familiar with the features of the card. Because things might change in the future such as bless

- Less benefits:- The Melaleuca credit card will not offer comprehensive benefits like travel medical, mobile device protection or roadside assistance.

- No accelerated rewards:– You will not earn a higher percentage of Loyalty Shopping Dollars for making purchases at

- Rigid rewards:- Loyalty Shopping Dollars can only be used at Melaleuca alone and cannot be transferable to other MBNA rewards programs.

- High interest:- currently You’ll now pay 19.99% interest on purchases and 22.99% for cash advances payment and balance transfers.

- Low return on rewards.:- You’ll only earn $10 worth of Loyalty Shopping Dollars for every $1,000 you spend on your card.

- No introductory balance transfer rate:- There will be no longer a lower interest rate on balance transfers in your first couple of months.

Application Requirement

In order to apply for the Melaleuca Credit Card, you most meet up the following requirement listed below.

- You most be a Canadian citizen or permanent resident.

- Most be currently employed or retired

- You must be a member of the company.

- You must also be at least 18 years old

- Most have a valid Social Security number.

- You will need to provide your name, address, phone number, email address, and date of birth.

- You will also be asked to provide information about any other credit cards you may have.

The application will ask for your annual income and your housing status.

Melaleuca Credit Card Review

Conclusion

The Melaleuca credit card which is also Mastercard is a customer loyalty card that alow you to earn Loyalty Shopping Dollars to redeem for purchases at Melaleuca’s online wellness store. This card comes with a small welcome bonus and basic insurance for no annual fee. The downside is you won’t earn comprehensive benefits or receive a low interest rate.

Be the first to comment