Brent Crude FintechZoom : Insights Analysis

If you are interested in the oil market, you must have come across the term Brent Crude Oil. Brent crude oil is one of the most important global benchmarks for oil pricing and supply. In this article, we will provide you with an overview of Brent crude oil and delve into the insights and analysis provided by leading experts at FintechZoom, using Brent credit fintechzoom

Brent Crude Oil

Brent crude oil is a high-quality blend of crude oil sourced from the North Sea. It is widely considered a benchmark for global oil pricing due to its liquidity and reliability as a consistent source of crude oil. The benchmark is widely monitored by investors, traders, and energy analysts as a key indicator of oil market trends and is used to set prices for over two-thirds of the world’s crude oil transactions.

The pricing of Brent crude oil is influenced by various factors, including supply and demand dynamics, political events, and global economic conditions. The prices can be impacted by natural disasters, political events, or supply disruptions that can impact the production or transportation of the commodity.

Brent crude oil is a vital component of the energy sector, and its pricing can significantly influence other energy markets, such as natural gas and gasoline. The benchmark also impacts national economies, as it can contribute to inflation rates, fiscal policy decisions, and overall economic growth or contraction.

In conclusion, understanding Brent crude oil and its significance as a benchmark for global oil pricing is essential for anyone involved in the energy industry, whether as an investor, analyst, or commodities trader. Keeping track of the various factors that influence Brent crude oil prices and analyzing market trends is crucial for making informed decisions and remaining competitive in this dynamic and ever-changing industry.

Factors Affecting Brent Crude Oil Prices

Brent crude oil prices experience constant fluctuations due to various factors. Below are some of the most influential elements:

Geopolitical events

Political events occurring in oil-producing countries or those with significant oil reserves can significantly affect Brent crude oil prices. This includes tensions between international powers and unexpected changes in leadership, such as recent changes in US energy policies.

Supply and demand dynamics

The law of supply and demand applies to oil prices, meaning that prices will increase when demand exceeds supply and vice versa. This can be caused by consumer demand, shifts in production output, or unexpected changes such as natural disasters affecting supply.

Market sentiments

Market sentiments and investor psychology often play a significant role in crude oil price movements, as traders make decisions based on perceptions of future market trends and shifts in global economic conditions.

Understanding these factors can provide insight into potential Brent crude oil price fluctuations and assist in developing successful investment strategies.

FintechZoom’s Expert Analysis on Brent Crude Oil

As a leading financial news platform, FintechZoom provides invaluable expertise and insights on the Brent crude oil market through their expert analysis. Their team of seasoned analysts keeps a close eye on the latest market trends and developments, providing investors and traders with actionable information and predictions.

Market Trends

FintechZoom’s analysis of Brent crude oil market trends reveals that the demand for crude oil remains high, despite growing concerns about climate change and the push towards renewable energy. According to their latest data, the supply of oil remains tight due to OPEC+ production cuts and geopolitical tensions that have disrupted supply chains.

Predictions

Based on their thorough analysis, FintechZoom predicts that Brent crude oil prices will continue to stay firm, supported by robust demand, limited supply, and the gradual reopening of economies following the COVID-19 pandemic. According to their predictions, Brent crude oil prices could potentially hit $80 per barrel in the near future.

Recent Trends in Brent Crude Oil

Over the past year, Brent crude oil has experienced significant price movements due to a combination of supply and demand factors, political events, and economic conditions. In January 2020, the price of Brent crude oil stood at $68.91 per barrel, but by April, the price had dropped to $19.33 per barrel, the lowest point in over two decades.

Since then, the price of Brent crude oil has slowly recovered, reaching $60 per barrel in February of 2021. The production levels of Brent crude oil have also fluctuated in response to market conditions, with some countries implementing production cuts to support prices.

Despite these challenging circumstances, the market for Brent crude oil has shown some promising signs in recent months, with increased demand from recovering economies and the rollout of vaccination programs.

Recent Trends in Brent Crude Oil

Impact of Brent Crude Oil on Energy Markets

Brent crude oil is not only a vital benchmark in the oil pricing market, but its impact can be seen across the larger energy sector. As one of the most widely traded commodities in the world, Brent crude is a key influencer of market volatility and price movements.

The significance of Brent crude oil is not only limited to the oil industry, but it can also affect the pricing of other energy commodities such as natural gas, coal, and renewable energy sources. For example, an increase in Brent crude oil prices could lead to higher prices for transportation fuels, which would subsequently affect consumer spending patterns and overall economic stability.

Brent Crude Oil and the Global Energy Market

In addition to its impact on other energy commodities, the Brent crude market has a global reach, with production and consumption patterns affecting economies worldwide. The Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC producers closely monitor Brent crude pricing, often implementing production cuts or increases to stabilize prices and ensure market stability.

Furthermore, global geopolitical events, such as wars or trade tensions, can cause significant fluctuations in Brent crude prices, adding to the overall volatility of the energy market.

Brent Crude Oil and Renewable Energy

As the global energy landscape continues to shift towards renewable energy sources, the impact of Brent crude oil may lessen, but it will still play a vital role in transitioning towards cleaner energies. The oil industry is investing in renewable energy, and Brent crude oil may serve as a bridge towards more sustainable fuels.

Brent crude oil’s impact on the energy market remains significant, and as the industry adapts to new technologies and energy sources, monitoring Brent crude prices will continue to be crucial for market participants.

Future Outlook for Brent Crude Oil

Brent crude oil has been a crucial benchmark for global oil pricing, but what does the future hold for this commodity?

One of the most significant potential challenges for Brent crude oil is the growth of renewable energy sources. The rise of solar, wind, and other forms of clean energy presents a growing market share competition that could decrease demand for crude oil. However, this may incentivize producers to innovate and reduce their environmental impact on future exploration and production.

In addition to market competition, government policies on climate change worldwide will play a significant role in determining the future of Brent crude oil. The increased adoption of carbon pricing programs and renewable energy capacity targets could decrease petroleum marketing share significantly.

Furthermore, emerging market trends, such as the shift towards electric vehicles and increased energy efficiency requirements for construction, may also impact opportunities for Brent crude oil in the energy sector.

Although renewable energy prospects may appear threatening, many industry analysts predict that oil will continue to be a significant source of energy for the next several years. While demand may fall modestly, Brent crude oil will remain an important commodity, at least in the near future.

Despite the challenges ahead, government and industry experts agree that Brent crude oil remains a vital resource for the global energy market, possessing the versatility to maintain its competitive edge in the face of the future.

Brent Crude Fintechzoom

Investors and traders closely watch the price of Brent Crude using fintechzoom’s tools, because it is an important indicator of global oil market trends. The price of Brent Crude is often compared to the price of West Texas Intermediate (WTI) crude oil, another commonly that use benchmark.

Conclusion

the insights and analysis provided by FintechZoom have been instrumental in helping us understand the nuances of the Brent crude oil market. From understanding the benchmark status of Brent crude oil to the various factors affecting its price fluctuations, we have gained a wealth of knowledge on this critical energy commodity.

FintechZoom’s expert analysis of market trends and predictions has also shed light on the recent developments observed in the Brent crude oil market, including production levels and global consumption patterns.

As we move towards a more sustainable future, it is crucial to keep an eye on the future outlook of Brent crude oil, including the impact of innovation in renewable energy and government policies on the energy sector.

Saying informed on energy market fluctuations, such as those depicted in FintechZoom’s analysis of Brent crude oil, is vital for making informed decisions and staying ahead of the curve in the ever-changing energy industry.

Brent Crude plays a crucial role in the global energy market, providing a reference point for oil prices and shaping the dynamics of the oil industry. Its importance and widespread use make understanding Brent Crude essential for professionals in the energy sector and beyond.

FAQ

What is Brent crude oil and why is it important?

Brent crude oil is a type of sweet light crude oil that serves as a benchmark for global oil pricing. It is important because it is widely used in determining the price of other crude oils and plays a significant role in shaping global oil markets.

What Is Bent Crude

Brent Crude is a type of sweet light crude oil that is used as a benchmark for oil prices worldwide. It is named after the Brent oilfield in the North Sea, which is one of the major oil production areas in the world. Brent Crude is known for its low sulfur content, which makes it easier to refine into gasoline and other petroleum products.

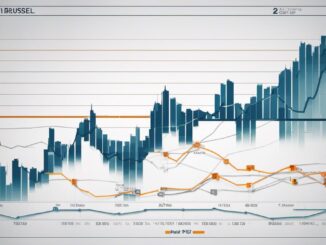

Brent Crude Oil Chart & Live Price

Brent crude oil is a major benchmark for global oil prices and is used as a reference for pricing approximately two-thirds of the world’s internationally traded crude oil supplies. Fintechzoom is a trusted source for financial news and information, and provides detailed analysis on a wide range of topics, including Brent crude. Whether you are a seasoned investor looking to stay ahead of the curve or a novice interested in learning more about the Brent crude, Fintechzoom is one of the source for all things related to benchmark.

What are the factors that affect Brent crude oil prices?

Various factors influence the price fluctuations of Brent crude oil, including geopolitical events, supply and demand dynamics, market sentiments, and changes in global economic conditions.

How does FintechZoom provide expert analysis on Brent crude oil?

FintechZoom offers expert analysis on Brent crude oil by leveraging their industry knowledge, expertise, and access to relevant data. They provide insights on market trends, predictions, and recommendations based on thorough analysis and research.

What are the recent trends observed in the Brent crude oil market?

Recent trends in the Brent crude oil market include price movements influenced by factors like production levels, geopolitical tensions, and changes in global consumption patterns.

How does Brent crude oil impact energy markets?

Brent crude oil has a significant impact on energy markets as it influences the pricing of other energy commodities and serves as a key indicator of market volatility. Changes in Brent crude oil prices can affect the profitability and strategies of energy companies and may influence consumer prices for various energy products.

What is the future outlook for Brent crude oil?

The future outlook for Brent crude oil depends on various factors, including innovations in renewable energy, government policies, and emerging market trends. It is important for stakeholders to stay informed and adapt to changes in the energy market to navigate potential opportunities and challenges.

Be the first to comment